Meet Our Media Suite!

Explore Our Subscription Options

STAND OUT from the Crowd

With our complete suite of communications solutions for your Public Relations and Investor Relations needs. We are the only Press Release Distribution provider offering a comprehensive Media and Investor platform to amplify your brand voice and strengthen communication with your audience.

Or call us anytime at 866-945-1780

Featured Press Release

of the Week

Our Latest Blogs

Industry-Leading

Press Release Distribution

Connect your stories with your most important stakeholders with ACCESSWIRE news distribution.

Media Suite

Jumping from platform to platform and juggling multiple logins for your media outreach is a thing of the past. Our Media Suite bundles our most powerful products including Media Database, Media Pitching, Media Monitoring and Media Room onto one platform. Maximize your media engagements and unlock your potential with one login.

Press Release Distribution

Gain the exposure your brand deserves with our global distribution network, reaching thousands of media outlets worldwide. Maximize your moments with our flat-fee pricing, unlimited word counts, graphics, and media. Experience the power of our press release distribution services today.

Press Release Optimizer

Enjoy thousands of extra views on your press release campaign with our Featured Press Release offering and have an exclusive article written about your brand that’s shared on social and earns you backlinks with our Company Spotlight option.

Online Media Room

Automate your press release feed, upload and organize brand assets, prioritize who sees your news by uploading a contact list, and analyze performance with our Online Media Room offering.

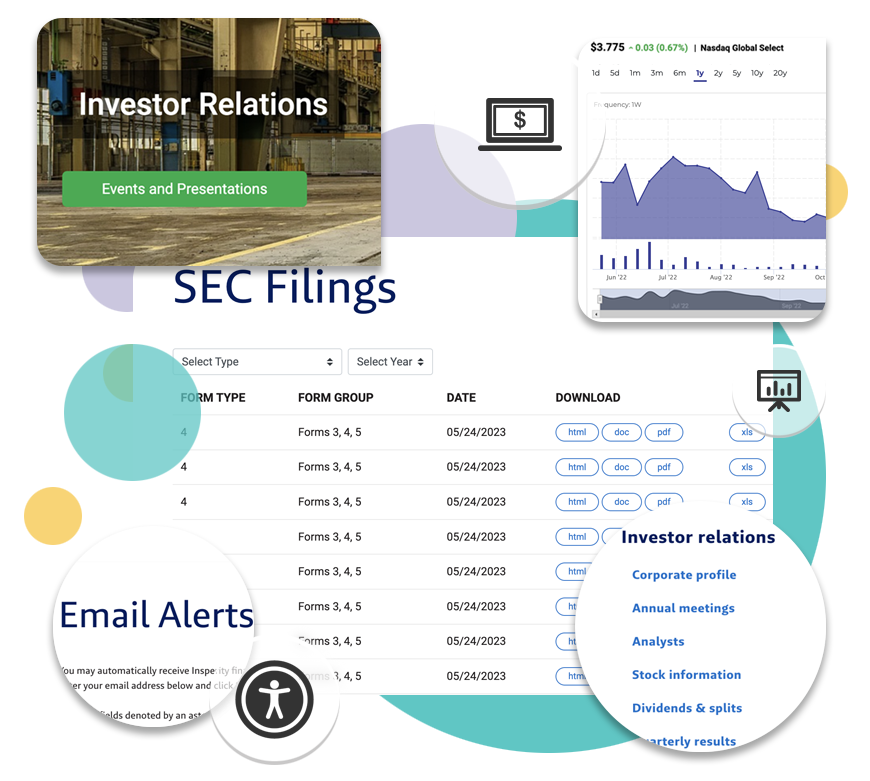

Investor Relations Websites

Build investor confidence with our customized, ADA compliant and easily editable IR sites. Hosting thousands of IR sites, we help the IR community provide a seamless experience for their investors and shareholders.

Trusted by Thousands of Brands

What People Are Saying

"Have to say, we really appreciate the way you and your teammates operate. Your attention to service and timely response is fantastic."

Bill T.

Learn and Earn

Button

"We have been a client of ACCESSWIRE's for 8 years. We have found them to be very professional, easy to deal with and are very attentive to detail. I would highly recommend ACCESSWIRE!"

Ben M.

Golden Oak Corporate Services Ltd.

Button

Simple, easy interface - putting out a release is a fast, easy exercise. The editors are friendly and knowledgeable. They don't nitpick and interfere with what I want to distribute. The cost is very reasonable. Review collected by and hosted on G2.com.

Henry S.

Owner - Small Business

Button

Our agency has worked with a number of press release wire services and none come close to the extraordinary service provided by ACCESSWIRE. We have 24/7 customer service and our sales rep is fantastic. We love ACCESSWIRE.

Beth T.

CEO / Founder - Small Businesss

Button

I like how quick it was to work on Accesswire. I like how the length didn't effect my price and that some images were included. Competitors should take note!

Chris H.

Small-Business

Button

One thing I am absolutely happy about - 24/7 support. Our team works in several time zones - from 3 to 7 hours difference, the information flow is therefore around the clock, and the ability to reach someone without thinking about the deadlines is vital.

Anna S.

In-house Counsel

Button

Contact Us Today

If you have questions or want to learn more about our products, our team’s here to help!

PRODUCTS

© 2024

ACCESSWIRE | All Rights Reserved